The article below details the relationship between age and its accompanying financial problems confronting seniors. The rise in bankruptcy filings is obviously expected to increase exponentially in the coming years.

The Florida Times-Union

August 28, 2008

Bankruptcy after a lifetime of getting by

By Matt Sedensky,

Associated Press ST. AUGUSTINE – First came the health problems. Then, unable to work, Ada Noda, 80, watched the bills pile up.Suffocating in debt, Noda did something she never thought she’d be forced to do.

She declared bankruptcy.

While the bankruptcy filing rate for those under 55 has fallen, it has soared for older Americans, according to a new analysis from the Consumer Bankruptcy Project, which examined a sampling of noncommercial bankruptcies filed between 1991 and 2007.

The older the age group, the worse it got – people 65 and up became more than twice as likely to file during that period, and the filing rate for those 75 and older more than quadrupled.

“Older Americans are hit by a one-two punch of jobs and medical problems and the two are often intertwined,” said Elizabeth Warren, a Harvard Law School professor who was one of the authors of the study. “They discover that they must work to keep some form of economic balance and when they can’t, they’re lost.”

That’s precisely what happened to Noda. She worked all her life, on a hospital’s housekeeping staff, and later selling boat tickets to tourists. She cut corners when she needed to, but always paid the bills she neatly logged in a ledger.

“I was born during the Depression,” she said. “I paid the bills whether I ate or didn’t, whether I went to the doctor or not.”

It all worked fine for Noda, a widow for 23 years, until she was forced to undergo double-bypass surgery and deal with respiratory problems. She started using two credit cards more frequently for food and bills. Before long, she was $8,000 in debt and behind on car payments.

“I’d go to bed and all I had on my mind was bankruptcy,” she said. “I had nothing left.”

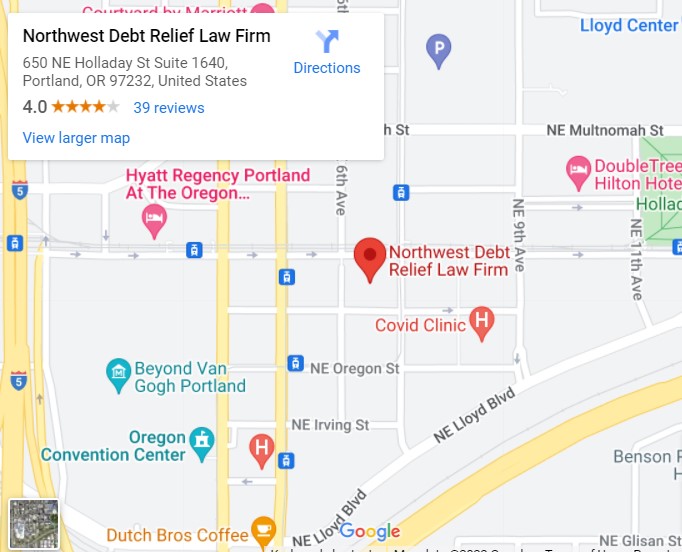

Noda’s car was repossessed, but her trailer home wasn’t in jeopardy because her daughter owns it. While she’s covered by Medicare and receives $968 in Social Security each month, she relied on her job for other expenses. She had no choice but to get help from Jacksonville Legal Aid and declare bankruptcy.

Most bankruptcies are still filed by people far younger than Noda, but the percentage the younger filers make up has fallen over the 16-year period, according to the Consumer Bankruptcy Project analysis, which will be published in the Harvard Law and Policy Review in January.

In 1991, the 55-plus age group accounted for about 8 percent of bankruptcy filers, according to the study, which looked at more than 6,000 cases filed in 1991, 2001 or 2007. By last year, filers 55 or above accounted for 22 percent.

Each age group under 55 saw double-digit percentage drops in bankruptcy filing rates over the survey period, older Americans saw remarkable increases. The filing rate per 1,000 people ages 55-64 was up 40 percent; among 65- to 74-year-olds it increased 125 percent; and among the 75-to-84-year-old set, it was up 433 percent.

Several factors are contributing to the increase. Higher prices for ordinary consumer goods have hit seniors on fixed budgets. For older Americans living below the poverty level, or not far above, a safety net likely doesn’t exist for economic setbacks such as medical problems. And some fall prey to scams that cripple their finances.

Warren noted increasing numbers of Americans are entering their retirement years with significant debt and are still paying off mortgages. She said it was wrong to assume that lives of luxury are bankrupting seniors; rather, they’re incurring debts to meet needs such as medical treatment.

“There’s no evidence that the problem is consumerism,” the professor said.

Nor is there a significant aging trend to blame. While the country is set to experience a notable age shift in the coming years, no major one took place between 1991, when the average age was 33, and 2007, when it was 36.

Frank and Hazel Peters lived frugally their entire 53-year marriage. They always rented a home, but decided after the husband’s retirement from a factory job that they would cash in his 401(k) and buy a manufactured home in Hastings, a town of cornfields and potato farms.

They fell victim to fraud when they tried to fix a plumbing problem that had black, smelly water coming through the pipes of their new home without enough funds to fall back on. They declared bankruptcy.

“We knew we had no other option,” said Hazel Peters, 73.

Bankruptcy, tough at any age, is especially hard when you don’t have many years left to recover. Warren said some seniors fear telling their families because they’re afraid they’ll be put in a nursing home if they can’t handle their affairs.